Diving into healthcare consumerism first requires a concrete definition of the new movement — here’s our take which was inspired by multiple interpretations from NRC Health, McKinsey & Company, and HealthLeaders:

The healthcare consumerism model sees the patient as a consumer and empowers them with the information and choices necessary to make better healthcare decisions to meet their needs.

With the right healthcare consumerism strategy in place, providers should see more engaged patients who are not just knowledgeable and accountable for their health but who also have a better sense of their healthcare options.

The Importance of Healthcare Consumerism (In Numbers)

The rise of healthcare consumerism didn’t just happen overnight. Shifting trends across the industry gave rise to the term and eventually the model that many providers and insurers are using today.

It all started with the consumer. NRC Health’s 2017 study revealed that 7 in 10 consumers feel that they are now personally responsible for managing their health. A major factor behind this shift is cost, and consumers are investing plenty of money into the healthcare industry.

A 2018 brief from the Baker Institute for Public Policy at Rice University showed that today’s health care spending accounts for 18 percent of the U.S. gross domestic product. Put it another way: since 2016, healthcare spending went up by $3.3 trillion.

However, consumers are becoming smarter with the money they spend on healthcare. Research from McKinsey & Company revealed that four major factors drive a consumer’s choice in a healthcare company. In decreasing percentage of importance they are:

- Coverage (23 percent)

- Customer service (11 percent)

- Cost (7 percent)

- Access (6 percent)

Based on these findings we narrowed down this guide on healthcare consumerism to focus on two main tenets. Providers and insurers need to:

- Be transparent in price

- Have personalized and easily accessible information

Healthcare Consumerism and Price Transparency

Consumers in the McKinsey study said that affordability in healthcare was a main pain point of frustration. Specifically, there were three main difficulties:

- Understanding basic costs

- Determining whether or not a specific treatment was covered in their plan

- Understanding their healthcare bill

This issue in overall costs means that people miss out on crucial care. Twenty percent of the respondents in the survey said that they don’t get the care they need; 60 percent of that group said that it was because of cost.

This underlines the fact that providers and insurers should make an effort to be transparent when laying out the costs for plans and treatment options for each customer. In addition, these prices should be easy to understand so that consumers aren’t caught off guard when they discover fees in their bill that weren’t mentioned previously.

Keep in mind that this method doesn’t exactly mean that consumers will always be attracted to the cheapest option available; it just means that they are better informed about the costs associated with the right insurance or health treatment.

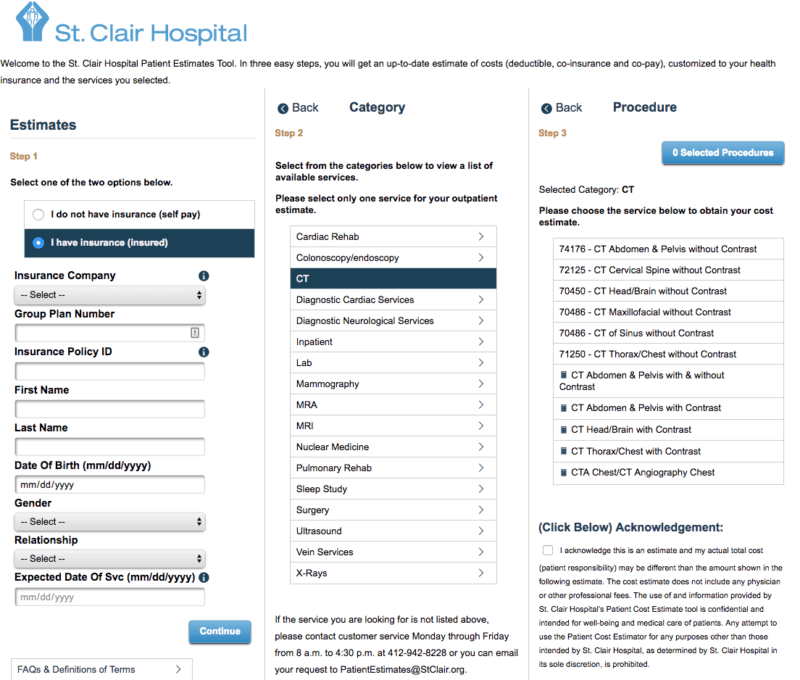

A real-world example of this approach is at St. Clair Hospital, which is located outside of Pittsburgh, PA. Its website includes an Estimates Tool, which helps consumers get a better idea of the price they have to pay for their treatment. Specifically, it includes details on the deductible, co-insurance, and co-pay associated with a treatment based on the consumer’s insurances and the services they selected.

Personalized and Easily Accessible Information in Healthcare Consumerism

Showing prices in a way that’s easy to understand is part of a larger effort to make all healthcare information easily accessible to anyone. However, providers will also need to make that information personalized for each customer.

There are current efforts that help this issue in the right direction, most notably in the form of patient portals. These digital repositories allow customers to easily view, download, or transmit their personal medical information, which is supposed to improve the patient experience.

Unfortunately, these portals aren’t heavily used by consumers. A report from the Government Accountability Office in 2017 revealed that even though 88 of hospitals and 87 percent of “eligible professionals” offered electronic access to patient data, only 15 percent of hospital patients and 30 percent of patients visiting their provider actually used it.

The McKinsey research showed a slightly higher percentage when it came to health insurance plans. Only 49 percent of respondents said they used “technologies provided by their insurer,” but they only performed basic actions on the platform such as updating their personal information, checking the benefits included in their plan, or to see the list of doctors and hospitals in their plan.

These statistics show a major pain point within the industry: consumers aren’t taking full advantage of the readily available digital healthcare tools.

One way to make these tools more appealing is by giving consumers a personal stake in their healthcare. Jones PR reported that 35 percent of consumers want to “have a better understanding of how to change unhealthy behaviors.”

It isn’t enough to provide information to consumers anymore; you have to make an effort to personalize the data so that they become more invested in their well-being.

This new approach is currently in development at the Duke Center for Personalized Health Care. Patients in the program identify areas of improvement in their life while providers utilize family history, lifestyle habits, and biometric data to gather information specific to the patient. This leads to the creation of a “timeline for health improvement” where the patient gradually works toward their health goals with additional support from doctors and nurses.

Another method of creating better consumers is to provide financial incentives. The McKinsey report revealed that responders were willing to make lifestyle changes to improve their health in different ways if it meant a reduction of $10 – $30 per month in their premiums.

The benefit is twofold: consumers become healthier, but they also stick with their healthcare plan because of the incentives it provides, which can save them money in the long run.

Creating A Better Consumer-Centric Healthcare Industry

Healthcare consumerism puts the onus on the consumer to make the healthcare choices that fit their needs and budget, but it’s up to the healthcare industry to meet them halfway by providing information like costs, incentives, and treatment options in a way that’s easy to understand.

With the help of insurers and providers, the consumer makes a smart and well-informed healthcare decision and picks a group that is highly invested in their well-being.