Creating an engaging and effective plan when it comes to social media for banking can be difficult because many consumers rely on – yet are reluctant to – trust banks.

- According to American Banker, banking is ranked second to last in terms of reputation score (63.2 / 100 points) when compared against 15 other industries.

- The second-highest factor for choosing a bank is trust with the brand (45% of consumers).

- A J.D. Power 2019 study shows that the customer perception of “banks having a good reputation and being customer-driven” was lower in 2019 than in 2009.

This begs a few questions: How can you connect effectively with consumers on social media to build trust? And how can you use social media to develop meaningful customer relationships?

Adopting social media best practices for banking can add value through brand activity and take a step towards a digital transformation in financial services. When done correctly, it can even transform the way your bank handles customer complaints, issues, and expectations outside of the traditional sales or service process. Best practices include:

Social Media Marketing Tips for Banks

Becoming versed in best practices for social media in the banking industry ensures competitive advantage. Effectively using multiple social media platforms can also help illustrate your story to customers and raise overall brand awareness.

1. Identify and Resolve Customer Issues

Make online community management a priority for your organization and part of your customer experience culture by expanding engagement beyond the usual posts, likes, and responses. A major factor affecting bank reputation is a decline in overall satisfaction, specifically when it comes to solving customer problems and addressing it in a timely manner.

By creating a strategy for handling and resolving customer issues on social media, you make it easier for people to engage and stay satisfied with your brand. Providing multiple avenues for customers to reach you leads to a higher level of satisfaction and overall retention.

2. Provide More Visual Content

Social media naturally demands visual content so don’t settle for pumping out text-only posts; upload photos, share a short video, create an infographic, or use emojis in your social media stories. Take time to tailor your content to capture the attention of your audience in each channel.

You should also make an effort to use social media to provide faces to names. Show your community the faces of your executives, agents, branch and location managers, as well as administrative and customer-facing staff. Let their faces and words humanize your brand.

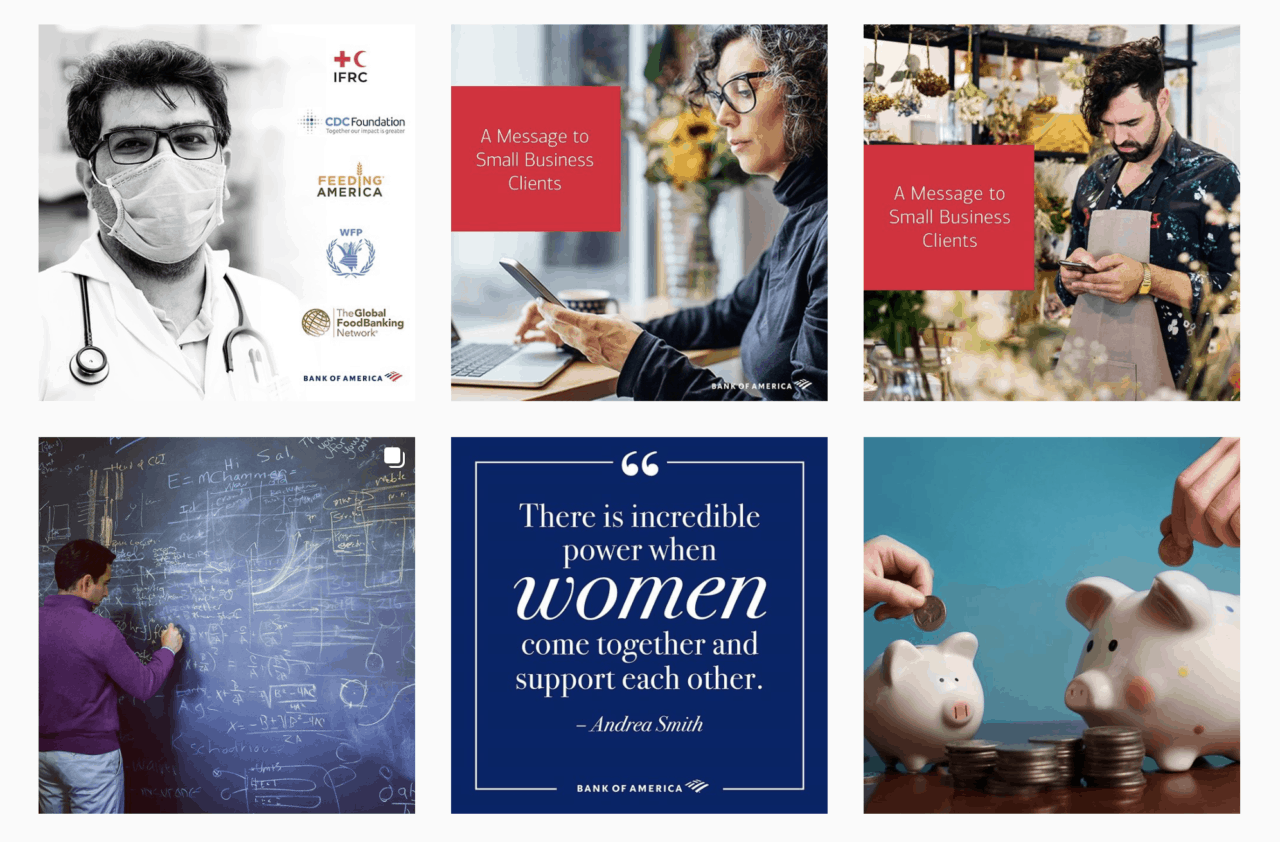

For example, Bank of America’s Instagram feed uses appealing visual content to tell customers about its staff, services, and new initiatives, all of which increases client engagement and retention. Social media is especially crucial during times of disruption, and serves as a lifeline for those who can’t engage with you in person.

3. Share and Respond to Reviews

If your bank or agency consistently receives five-star ratings and glowing reviews, don’t hesitate to share them on your social media profiles.

A TransUnion report showed that 8 in 10 consumers would switch to a different financial institution for a better experience. Using rave reviews as a key promotion tool is the valuable social proof future customers need to convert, and is sometimes more effective and engaging than loud sales messages and traditional brand content.

In addition to sharing reviews, success in social media for banking also requires commitment to becoming a responsive brand. While this sounds simple enough, coordination can be difficult for banking organizations with many locations. Managing multiple listings and profiles across different social media and online review sites makes responding to comments and online reviews a real challenge to both time and resources.

To alleviate coordination issues and create a positive online reputation, consider investing in review management tools that drive efficiency. You can also create something akin to a Hootsuite reputation management plan to closely monitor customer reviews across your listings and social media accounts and respond in a timely manner.

Need help in writing responses? Check out these examples of how to respond to reviews and customer feedback.

4. Aim to Inform and Educate

Consumers are more willing to follow your bank on social media if you become a leading source of helpful information. Share money management tips or spread the word about banking safety practices. You can also join awareness campaigns (like Central Pacific Bank who began the #KeepHawaiiCooking campaign on Instagram by providing gift cards and meals to frontline workers to support local restaurants) and engage further in social media conversations that impact the financial services industry.

Visual content is a must in this space because some financial jargon can be difficult to understand. Take the time to provide images and assign proper context to make complex information easier to digest and understand. Doing so increases customer trust, which leads to better reviews, more referrals, and a higher retention rate.

Sustaining A Successful Social Media Banking Strategy

Creating an engaging, responsive, and informative banking brand on social media doesn’t happen overnight, especially if consumer trust is low. However, it is important to create and execute a social media strategy that puts the consumer first.

Showing transparency, responding to feedback, and listening to what consumers have to say on Twitter, Facebook, and other social platforms is vital to a better client experience and in creating more loyal customers who spread the word about your bank to potential customers.